Medicare insurance

Insure My Life Right is an insurance brokerage for Medicare plans for seniors, Medicare Supplements, Medicare Advantage plans & PDP’s (prescription drug plans).

Medicare plans cover different types of care, including inpatient hospital stays, outpatient care, prescription drugs, and more.

- Medicare Part B charges a 20% coinsurance on many outpatient services.Regular Medicare by itself doesn’t cover 100% of medical costs, and most plans require a deductible.This is why there are Medicare Insurance plas.There are 3 main types of Medicare insurance plans.1. Medicare Supplements2. Medicare Advantage Plans3. Prescription Drug Plans (PDP’s).

Medicare Insurance Companies we represent.

- Aetna

- Anthem

- Alignment

- All State

- Cigna

- Humana

- Medico

- Molina

- Scan

- Select Health, Utah

- United Health Care (UHC)

- WellPoint

- Wellcare

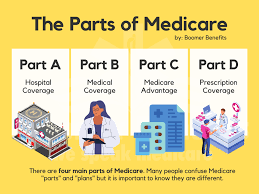

Type of Medicare Plans

- Part A

Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Part B

Covers outpatient care, medically necessary services, preventive services, and certain doctors’ services

- Part C

Medicare Advantage (MA & MAPD/Medicare Advantage & Prescriptioin Drug plan),

SNP – Special needs Plan

Dual Eligible plans (Medicare/Medicaid), D-SNP Plans

Medicare Advantage plan’s are offered by private insurance companies that are approved by Medicare.

Most Medicare Advantage plans include Part D drug coverage.

A Medicare Advantage Dual Eligible Special Needs Plan (D-SNP) is a type of Medicare Advantage plan that offers specialized care and services for people who are eligible for both Medicare and Medicaid.

- Part D

Prescription Drug Plans (PDP’s) – Provides prescription drug coverage for a monthly premium.

- Program of All-Inclusive Care for the Elderly (PACE)

A Medicare-Medicaid program that helps people with health care needs in the community.

Medicare Supplement Benefits

Focuses on covering most out-of-pocket costs. Medicare Supplement plans have some advantages, including:

- Provider choice: Medicare Supplement allows freedom of provider choice.

- Nationwide Provider List

- Minimal additional expenses: Medicare Supplement typically has higher premiums but minimal additional expenses.

- Before choosing your coverage, it’s important to review your healthcare needs and Medicare options.

- Does not include Prescription Drug Plans (PDP’s) – Part D

Medicare Advantage BenefitsPlans & Benefits

- A popular alternative to Original Medicare that offers broader coverage, including prescription drugs, dental, hearing, and vision care.

- Extra benefits: These can include routine dental, vision, and hearing care, prescription drug coverage, fitness programs, and over-the-counter drugs.

- Annual out-of-pocket limit: Plans have an annual limit on out-of-pocket costs for covered services. Once you reach this limit, you won’t pay anything for covered services.

- Bundled structure: The Bundled structure offers many additional medical services & extra benefits in Medicare Advantage plans than what Medicare Supplement plans offer.

- Prescription drug coverage: Most Medicare Advantage plans include prescription drug coverage.

- $0 monthly premiums: Some Medicare Advantage plans have $0 monthly premiums.

- Preauthorizations and referrals: You may need preauthorizations and referrals for many types of care, including seeing a specialist.

- Out-of-pocket costs: MA plans often have lower premiums and may have higher out-of-pocket costs.