Indexed Universal Life Insurance (IUL) • Lifelong coverage + flexible cash value

IUL Insurance: Lifelong protection with cash-value growth potential—without direct market risk.

Indexed Universal Life (IUL) is permanent life insurance that can build cash value based on a market index (like the S&P 500®) with downside protection features (typically a 0% floor, depending on the policy). It can work well for families, high earners, and business owners who want protection and flexibility.

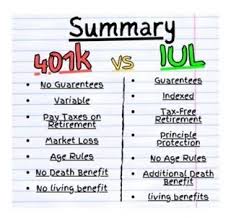

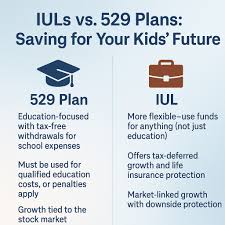

Learn about 401-K vs IUL (indexed universal life insurance) & 529 College Savings Plans vs IUL’s.

Insurance strategies that fit real life

Call/Text: 801-747-9176

Get an IUL illustration

Schedule a call

Adjust contributions as life changes (within policy rules).

Potential tax-deferred growth; tax-free access may be available via loans/withdrawals (rules apply).

Upside potential with caps/participation rates—built to limit downside.

Want to see real numbers?

Get a personalized IUL illustration built around your goals, timeline, and budget.

When it’s built right, it can be a powerful tool. When it’s built wrong, it can disappoint.

What is Indexed Universal Life (IUL)?

How it works (plain English)

IUL is permanent life insurance. Part of your premium pays for the insurance costs; the rest can build cash value.

The cash value can be credited based on the performance of an external index—typically with:

- Floor: helps limit downside crediting in down years (often 0%, varies by product)

- Cap: limits the maximum credited interest in up to years

- Participation rate: percentage of index gain used to calculate credited interest

Who it’s for (and who it isn’t)

IUL tends to fit people who want permanent coverage and are willing to hold it long-term.

- Good fit long time horizon (10–20+ years)

- Good fit, stable income, and ability to fund consistently

- Caution: short-term goals or “quick cash value” expectations

- Caution: underfunding policies (can cause rising costs later)

IUL vs Term vs Whole Life (fast comparison)

| Feature | Term Life | Whole Life | IUL |

|---|---|---|---|

| Coverage length | Temporary (10–30 years) | Permanent | Permanent (if properly funded) |

| Premium flexibility | Usually fixed | Fixed | Flexible within rules |

| Cash value | None | Guaranteed growth + dividends (not guaranteed) | Index-linked crediting with caps/floors |

| Best for | Affordable protection | Certainty + guarantees | Flexible strategy + long-term growth potential |

| Key tradeoff | Ends unless renewed | Higher cost | Needs correct design + monitoring |

Why do people use an IUL

401-k vs IUL (Indexed Universal Life Insurance)

529 College Savings Plan vs IUL (Indexed Universal Life Insurance)

401-k vs IUL Indexed Universal Life Insurance

529 college saving plan vs IUL

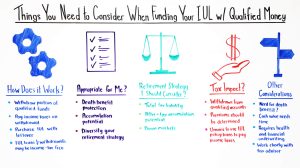

Things you need to consider when funding your IUL with Qualified Money

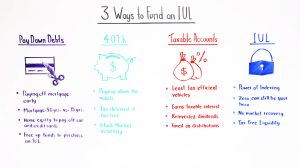

Three (3) Ways to Fund an IUL

1) Lifelong protection

Permanent death benefit for family protection, wealth transfer, or business planning (assuming policy stays in force).

2) Cash value access

Cash value index universal life insurance offers the ability to access the cash value of the policy through withdrawals/loans.

Loans reduce benefits and may create tax consequences if the policy lapses.

It is important to maintain sufficient cash in the policy so that it does not have the policy either cancelled or lapse.

3) Retirement income strategy

For some clients, structured funding can support tax-advantaged access later — when aligned with real risk tolerance and time horizon.

4) Downside crediting protection

Index-linked crediting often includes a floor (varies by product).

You’re not directly invested in the market index.

5) Flexible funding design

Some policies can be designed to emphasize cash value growth while keeping insurance costs efficient.

6) Customization

Options may include riders (chronic illness, term riders, etc.).

Availability varies by carrier/state.

How we build an IUL the right way

1: Clarify your goal

- Protection first (Life Insurance) vs cash value growth & Tax Free Income planning

- Timeline (10/15/20+ years)

- Budget and funding – How do you plan to fund your IUL? 1031 Transfer, a one-time dump in, monthly, annual, multi-year payment, or premium financing (Bank funds the premiums).

2: Design & compare options

- Illustrations built for realistic assumptions

- Stress tests: low/medium/high crediting scenarios

- Carrier comparison: costs, features, indexing choices

3: Underwriting

- Health & lifestyle review

- Labs/medical records as needed

- We shop for the best fit based on your profile

4: Ongoing service

- Annual review

- Adjust funding if your situation changes

- Keep policy performance aligned with your goals

Talk with a licensed agent

Call/Text 801-747-9176 or book a time that works for you.

Indexed Universal Life FAQ (no fluff)

Who is an IUL designed for?

An IUL is designed for someone who likes to invest funds, would like to over-fund their investment account(s), has or will max out their annual contribution limits, can put large amounts of funds into a vehicle; they would like to have access to their funds without a tax-penalty for withdrawing funds early, unlike a 401-K or a 529 Savings account that will penalize the account holder for early withdrawal and taxes.

Is an IUL “guaranteed” like a bank account?

IUL typically uses caps, participation rates, and floors to shape outcomes. The policy has costs.

If underfunded or poorly designed, it can underperform.

Can I lose money in an IUL?

but policy costs still exist. In weak crediting periods, cash value can grow slowly, stay flat,

or decline due to charges—especially if funding is low.

If you think you might cancel within a few years, term life or another product may be better.

What index does it use?

The carrier uses a crediting formula tied to index performance with caps/participation rates/spreads.

How do loans work for “tax-free retirement income”?

If a policy lapses or is surrendered with outstanding loans, taxes can be triggered. This strategy is highly design-dependent.

How long should I keep an IUL?

What’s the biggest mistake people make with IUL?

then never reviewing it. Design + funding + time horizon matters.