Premium Financing – Use Bank Financing to fund premiums for IUL’s for High-Net-Worth Investors.

How High-Net-Worth Investors Use Index-Based Growth and Bank Capital to Build Tax-Efficient Wealth

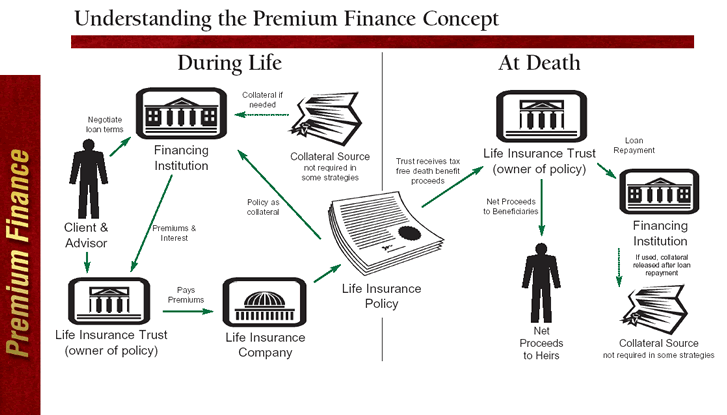

We use life insurance estate tax planning, where we use banks to fund the premiums rather than the policyholder using their personal funds.

Leveraged Indexed Universal Life (IUL)

This approach utilizes a specially structured life insurance contract paired with institutional bank financing to create a leveraged, tax-advantaged wealth vehicle.

For the right clients, premium financing with life insurance often provides a great complement to other common advanced wealth strategies.

Why Sophisticated Investors Prioritize This Model:

- Optimized Compounding Traditional investing is a “two steps forward, one step back” journey.

- By using an IUL structure, gains are locked in annually.

- When the market drops, your account remains flat rather than retreating.

- This creates a smoother, more predictable compounding curve.

Enhanced Capital Efficiency:

When you fund an asset solely with your own capital, your growth is capped by your personal cash flow.

By utilizing institutional leverage, you:

Magnify the Asset Size:

Control a larger death benefit and cash value from day one.

Arbitrage Opportunities:

Aim to capture a spread between the index credit and the cost of the bank’s capital.

Balance Sheet Optimization:

Move from a “spent” premium mindset to an “asset-backed” financing mindset.

The Power of Tax Alpha

In a high-tax environment, tax efficiency is often more valuable than raw investment returns.

This strategy provides a “Triple Tax Advantage”:

- Tax-Deferred Growth on all internal gains.

- Tax-Free Access to capital via structured policy loans.

- Tax-Free Transfer of the death benefit to heirs or foundations.

Index-Linked Credits:

Cash value growth is tied to the performance of major benchmarks (like the S&P 500) without direct market exposure.

Downside Protection:

Contractual floors ensure that while you participate in the upside, your principal is protected from market volatility.

Institutional Funding:

A lending institution provides the capital to fund the premiums, using the policy itself as the primary collateral.

Liquidity Preservation:

Personal capital remains unencumbered, allowing it to stay invested in your business, real estate, or other core assets.

The Mechanics of the Strategy:

How It Works

We have banks that fund between 70 to 90% of the policy in most cases & on occasion, 100% of the premium(s).

The policyholder needs to pay either a small percentage of the premium or the interest on the premium. They will also be required by the bank to put up some collateral, marketable securities, bank accounts, cd’s, money market accounts, Treasuries, and other assets.

The policies can go up to 100 Million USD for each IUL Life Insurance policy, and we can have multiple insurance companies for those who qualify for multiple policies.

higher-return investments.

This is not a retail product; it is a sophisticated financial structure typically reserved for:

- High-Income Individuals & Professionals looking to hedge against future tax increases.

- Business Owners seeking a high-limit executive carve-out or exit strategy.

- Real Estate Investors want a liquid, non-correlated reserve.

- Estate Planners focused on efficient multi-generational wealth transfer.

- Creating Tax-Free Income using Bank Leverage with a tax-free death benefit.

Each person has their own unique set of circumstances financially, and in all aspects of estate and business planning, each family has a different need for their insurance coverage. Each insurance company has different specialties. Because we represent many carriers, we have more options with better choices for our clients. As a broker, we have many different choices for the clients that we serve.

- As of February 2026, The average interest rate on the Premium Finacning Loan Rates range from 5.5% to 6.5% interest rate.

- The average rate of return has an illustration rate of 8 to 8.5% rate of return.

-

There is no guarantee that index-linked credits will exceed the cost of the bank loan.

- Lapse & Tax Risk:

- Tax-advantaged growth and tax-free access to capital are contingent on the policy remaining in force until the death of the insured.

-

We have policies that are only for the death benefit and estate tax issue benefits; they can also be used to generate tax-free income.

- Tax Liability:

- If the policy lapses or is surrendered while a loan is outstanding, the loan balance becomes immediately taxable as ordinary income to the extent it exceeds the policy’s cost basis.

- Market Impact:

- A “0% floor” prevents market-driven losses but does not stop the cash value from declining due to policy fees, mortality charges, and loan interest.

Why High-Net-Worth Investors & Businesses Use It

-

For others, it’s getting the right coverage based on their set of circumstances. Many people don’t know they can get help from more options than from the insurance companies they applied through, or agents they’ve worked with have turned them down.The Bottom Line: The wealthy don’t simply ask, “What is the return?”They ask, “How do I grow my capital while maintaining control, minimizing risk, and eliminating tax friction?”Premium-Financed IUL can be a strong answer to that question.This strategy utilizes Indexed Universal Life (IUL) insurance, not a direct investment in the stock market or index funds. While the policy tracks benchmarks like the S&P 500, it is a protection product with internal costs and fees.This is a complex financial structure intended for high-net-worth individuals who meet specific financial and risk- tolerance requirements. Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company.

Who It’s For

- High net-worth individuals, businesses for their owners/executives/ key-man employees.Net worth & Income Requirements:250,000 Annual IncomeNet Worth: 2 Million USD of Assets or greater

US Citizens & Non-US Citizens

-

The net worth can be from assets of:

Real Estate, marketable securities, bank accounts, cd’s, money market accounts, Securities, stock, Bonds, Treasuries, and other assets.

A majority of clients for Premium financing are real estate investors and business owners.

- Next Steps

-

If you want to see how this strategy may apply to your situation, book a short call, and we will gather the details for your circumstances, then we will come back with a few different options. From there, it’s which option makes the most sense for your circumstances. - What we’ll cover: goals, liquidity needs, collateral structure, loan terms, policy design constraints, and risk checks.

- What to bring: Personal financial statement, list of assets & Liabilities, Balance sheet, time horizon, and any existing policy(‘s)/loan docs.

- Disclosures

This strategy utilizes Indexed Universal Life (IUL) insurance, not a direct investment in the stock market or index funds. While the policy tracks benchmarks like the S&P 500, it is a protection product with internal costs and fees. This is a complex financial structure intended for high-net-worth individuals who meet specific financial and risk tolerance requirements.

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company.

Leverage & Interest Risk:

Using bank capital to fund premiums involves variable interest rate risk.

Negative Spread:

If loan interest rates rise above the policy’s credited rate, the policyholder may be required to pay interest out-of-pocket or post additional collateral.

Performance:

There is no guarantee that index-linked credits will exceed the cost of the bank loan.

Lapse & Tax Risk:

Tax-advantaged growth and tax-free access to capital are contingent on the policy remaining in force until the death of the insured.

Tax Liability:

If the policy lapses or is surrendered while a loan is outstanding, the loan balance becomes immediately taxable as ordinary income to the extent it exceeds the policy’s cost basis.

Market Impact:

A “0% floor” prevents market-driven losses but does not stop the cash value from declining due to policy fees, mortality charges, and loan interest.